Steps for the significance of Natural Account Qualifier

1. Types of Natural Accounts

and their Details

2. Flex field Qualifiers Setup

3. How and where the type of account was assigned to Natural segment values in oracle apps.

- Types of Natural Accounts and their

Details

There are 5 natures of account. Every account can have any

one nature and that’s why we can also call it natural account.

These natures are:

1. Assets

2. Liabilities

3. Revenue

4. Expenses

5. Owner’s Equity

ASSET: Literally asset is anything which is valuable to a person, organization, or any entity. For example, we say that “his quick learning ability is an asset to him” or “Her writing ability is her asset”. Why do we say that? Because quick learning skill or writing ability adds value to a person. A writer sells his writing skills to earn money, similarly in terms of business anything which is valuable to a business is the asset.

Say your

organization is a pharmaceutical and manufactures Medicines, then all the chemicals used to manufacture medicine is your asset or in other words

the Raw Material is your asset. The cash your organization own is an asset

because it can be used to buy items or pay your employee who

in turn are used to run your business. There are different types of assets, the

broader categories of asset are Current Asset and Fixed, but let’s not discuss it

here. For now, it is enough to know that asset is anything which is valuable to

your organization.

Asset INCREASES

when it is Debited and DECREASES when Credited.

Any organization which is registered with the government and exists as Legal Entity is obligated to disclose its Assets on the balance sheet to the government and its Creditors. You might ask Who are creditors and why is it that an organization is obligated to disclose asset to them? With Creditor comes in the liability.

LIABILITY: Comes from the

word “Liable”. Literal meaning of Liable is “to be

obligated”, “to be responsible” or “Legally responsible”.

In terms of accounting, you become liable, responsible to pay when you buy or

purchase anything from another entity. You are liable to

compensate whatever you’ve bought. Generally, an organization records its

liability and pays it afterward. Again, there are different types of

liabilities like Short Term Liability and Long-Term Liability.

Liability INCREASES when it is Credited and DECREASES when Debited.

OWNER’S EQUITY: This is the share of owner in the business. Equity INCREASES when it is Credited and DECREASES when Debited.

REVENUE: It is the total gain before

inducting any expense. It is mostly associated with the Asset. When any

organization sell goods or renders its services, it records an increase in

Asset and with this increase comes the gain it has made from selling the goods

or services. This gain is called Revenue or Income.

Revenue INCREASES

when it is Credited and DECREASES when Debited.

Revenue is not

displayed in Balance Sheet. They are reflected in Owner’s Equity.

EXPENSE: Any payment made is an expense. How are payments made? Either by Cash or Credit which eventually means Cash. So redefining Expense “The outflow of cash to any person or organization for its supplied Goods or rendered Services”. We incur expenses daily, for example, taxi fare is an expense, dine-out payments are expenses. Expenses are associated with Liability. Whenever an organization books a liability, it is mostly against some expense. There is different type of expense

Expense INCREASES

when it is Debited and DECREASES when Credited.

Following table

shows the Tabular form of the effect

|

Nature |

DEBIT |

CREDIT |

|

Asset |

Increase (+) |

Decrease (-) |

|

Liability |

Decrease (-) |

Increase (+) |

|

Equity |

Decrease (-) |

Increase (+) |

|

Revenue |

Decrease (-) |

Increase (+) |

|

Expense |

Increase (+) |

Decrease (-) |

Flex

field Qualifiers Setup:

Flex

field Qualifiers are registered as part of Flex field Registration.

Navigation:

Flex field Registration Form

Query For the title

“Accounting Flex field”

Then Click

the Qualifiers button in the above form to check

the registration of Flex field Qualifiers and Segment

Qualifiers.

To check the types

of Segment Qualifiers allowed Query for the Quick code type mentioned in

the above screenshot in quick codes form.

In Oracle General Ledger, when we attach the “Natural Account” Flex field Qualifier to a segment. System attaches the above set of nature on the Value form. When we add the Natural Account Value, we have to define the nature of the account as well.

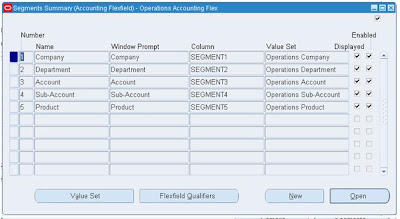

How and where the type of account (Segment Qualifiers) was assigned to Natural segment values in oracle apps.

Query for the title “Accounting

Flex field” in the SEGMENTS Form

Click on the segments button

in the above form to view segment details

Choose the appropriate

segment and click the “Flex field Qualifiers” button to view the below screen

Close the form and open the

“values” to check the values attached to segment

Query for the Accounting

Flex field

Choose the segment which has flex field Qualifier as “Natural Account” and then click the “Values, Hierarchy, Qualifiers” tab to check the segment qualifiers assignment.

No comments:

Post a Comment